-

Can be used at any time

-

Availability of all services on an extraterritorial basis

-

Possibility of making electronic payments

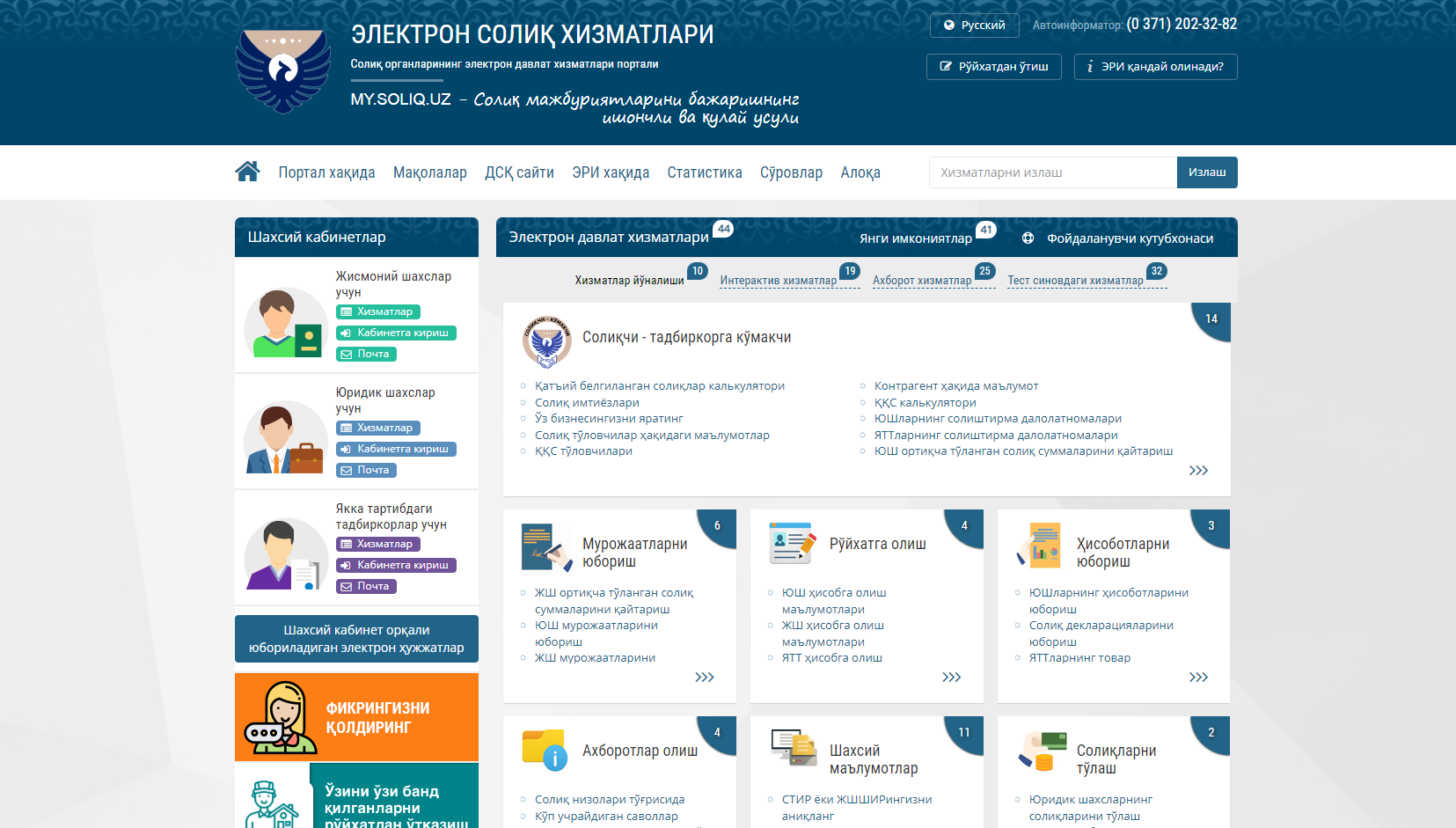

is the point of use of electronic government services provided by tax authorities.

Electronic government services intended for individuals and legal entities are provided on the Unified Portal in certain areas.

Using the portal, you can use electronic tax services without leaving your home. All you need to do is fill out the electronic form and submit an application to use the required service. For example, a tax calculator, a reconciliation report, a refund of overpaid taxes, obtaining certificates of absence of tax debt.

Purpose and objectives of the Portal

- creating favorable conditions for taxpayers to fulfill their tax obligations;

- provision of services to taxpayers in electronic form and on an extraterritorial basis;

- improving the quality of public service provision by creating transparent mechanisms for the provision of public services, reducing deadlines and centralized control over the execution of the procedure for their provision;

- reduction of costs for citizens, business entities and government agencies when receiving public services.

Registration on the Portal

When individuals and legal entities register as taxpayers with the tax authorities, a personal account is automatically created for them. To use the services on the tax services portal, just log into your personal account through one of the tools of the Unified Identification System ( login -password id.egov.uz , Mobile - ID , EDS , ID - card )

-

use electronic government tax services

-

sending requests to tax authorities, monitoring the status of sent requests and downloading service results

-

execution of tax obligations in electronic form

-

constant monitoring of the status of taxes and debts