Electronic payment service - Click

One of the key fintech solutions in Uzbekistan, through which citizens and businesses can pay taxes, fines, utility bills, government fees and other services. The platform functions as a Super App, combining a payment service, P2P transfers

m.click.uz

Advantages

-

● Market Leader in Digital Payments: Share up to 41% on Humo card, 33% of all transactions

-

● Mass Penetration: >20 million registered users, >5 million identified.

-

● Multifunctionality: Combines payment for services (taxes, utilities), transfers, mini-apps, integration with government services.

-

● Social Responsibility: Charity campaigns (Inson Uchun), environmental initiatives

-

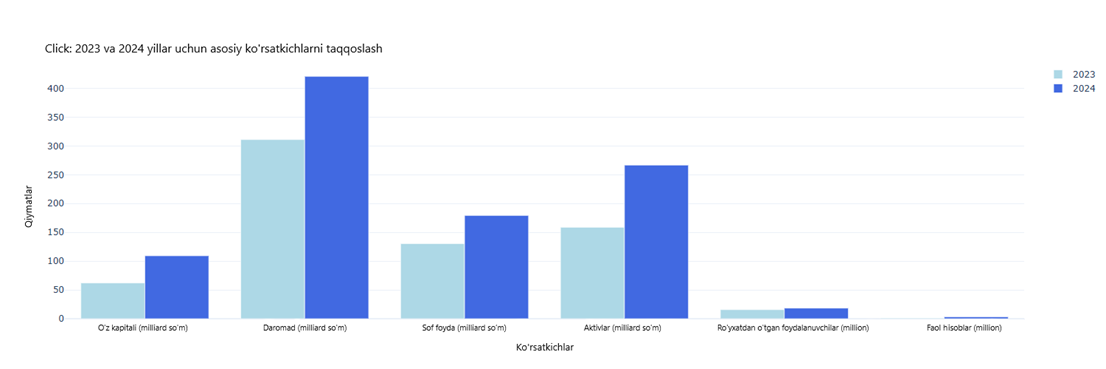

● Growth Speed and Innovations: Revenue +35%, profit +37% as of September 2024, asset growth >60%.

-

● Wide Coverage: App available via Telegram bots, USSD codes, covering rural and remote areas.

Goal and objectives

- Simplifying access to payment for state and commercial services through a unified interface.

- Supporting the transition to a cashless economy and digitization of banking services.

- Expanding financial inclusion (especially in remote regions) via USSD, Telegram, and the Click mobile app.

- Integration with government services.

- Supporting charity and environmental initiatives (Inson Uchun, Yashil Meros).

Registration and Integration with Government Services

- Registration is possible via the Click Up app, Telegram bot, or USSD codes.

- Identification is done through Me-ID / FacePay, unlocking access to advanced services.

- The platform is integrated with government services: Soliq, e-gov, my.gov.uz, as well as Humo and Uzcard bank cards.

Statistics and data on projects

Capabilities

-

● Payment for Government Services: Taxes, fines, utility bills, court fees.

-

● P2P Transfers: Instant transfers without fees within family groups.

-

● Mini-Apps: Auto insurance, power of attorney, kindergarten payment, cinema, delivery, rental, etc.

-

● "On-Site Payment" Service: Payment for purchases via QR at points of sale with cashback.

-

● Fintech Integrations: Loans, ticket booking, travel, etc., through the Uzum ecosystem.

-

● Environmental and Social Programs: Fundraising, eco-points, assistance to those in need.